What is consumer support?

The Consumer Support Grant (CSG) allows individuals with disabilities to purchase items, services and supports needed due to the individual’s disability. … in a way that gives the individual more choice, control, flexibility and responsibility.

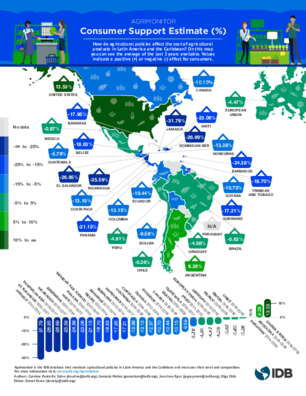

What is PSE in agriculture?

The producer support estimate (PSE) (formerly producer subsidy equivalent) is an indicator of the annual monetary value of gross transfers from consumers and taxpayers to agricultural producers, measured at the farm gate level, arising from policy measures that support agriculture, regardless of their nature, …

What does a negative producer support estimate mean?

A negative CSE indicates an implicit tax on consumers (i.e. consumers pay domestic prices that are higher than international prices), while a positive CSE suggests an implicit support (i.e. consumers pay domestic prices lower than the international prices).

What is a business support unit?

This is a local service aimed at local businesses to offer proactive legal advice and support when you need it. Most businesses experience problems at some time. When they arise it can be stressful to try and find some help at that time.

Is caregiver income tax free?

Filing Exemptions for a Dependent as a Live-In Caregiver

If you look after your aging parent or relative, you may be able to claim them as a dependent on your taxes, meaning that you are able to receive a tax exemption for them. If they qualify, this reduces your taxable income by $4,050 (as of 2016) per dependent.

Do I have to file Ihss w2?

You should contact the provider of the Form W-2 to find the EIN. You need a W-2 with an EIN so that you can e-file your return. To file without a W-2 form, you’d need to complete a Form 4852, Substitute Form for W-2, and you can’t e-file this with your tax return.

What is nominal protection coefficient?

The simplest measurements of protection are “price gaps” measures. Amongst those, the most popular measure is the so-called “nominal protection coefficient” (NPC), defined as the percentage ratio between the domestic distorted price and the counterfactual (undistorted) price.

Does Michelle P Waiver count as income?

The California Legislature enacted the California Earned Income Tax Credit (CA EITC). … Following the Feigh decision, Medicaid waiver payments are still not includible in federal gross income and are not subject to California withholding and therefore, those payments do not generate the CA EITC under California law.

What is an IRS Notice 1445?

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). … If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.

What are examples of support services?

- food pantries and soup kitchens.

- homeless shelters.

- substance abuse/addiction counseling.

- domestic abuse intervention.

- parenting resources.

- clothing assistance.

- free and low cost medical clinics.

- legal aid providers.

How do I file a notice of 2014 7?

You should write “Notice 2014-7” on the dotted line for Schedule 1, line 8, if you file a paper return, or enter “Notice 2014-7” on Schedule 1, line 8 for an electronically filed return.

Is DSHS income taxable?

If you are an Individual Provider who lives with your client, the income you earn for providing care services can be excluded from your federal income taxes. DSHS cannot provide Tax Advice.

What are support services?

Support Services means those activities provided to or on behalf of a person in the areas of personal care and assistance and property maintenance in order to allow a person to live in the least restrictive environment.

What is the difference between customer support and customer service?

The difference between customer service and customer support is that customer support teams support a product, while customer service teams provide service to a customer. … The customer has everything they want, but there’s no other feedback or information that goes into the experience. It’s transactional.

Who is entitled to a Community Care Grant?

You must be getting Income Support, income-based Jobseeker’s Allowance, Employment and Support Allowance (income-related), Pension Credit, or payment on account of one of them (or about to get any of them on leaving an institution or residential accommodation in which you have received care) in order to be eligible for …

What is a business support service?

Business support services means establishments primarily within buildings, providing other businesses with services including maintenance, repair and service, testing, rental, etc.; also includes: blueprinting business; equipment repair services (except vehicle repair, see “vehicle.

What can you claim for on a community care grant?

- furniture.

- household equipment like a cooker or washing machine.

- travel costs.

- removal expenses.

- storage charges.

How do I get my project funded?

- Apply for Grant Money. Grants are sums of money given to support cultural or research projects. …

- Go to an Artist Residency. …

- Use a Crowdfunding Platform. …

- Sell Your Own Photo Book. …

- Win a Commission.

What qualifies as difficulty of care payments?

“Difficulty of care payments” is defined in Code Section 131(c)(1)(A) as “compensation for providing the additional care of a qualified foster individual.” In other words, if you provide care in your home to an individual who has a physical, mental or emotional handicap, including payments received for caring for …

Is consumer support grant taxable income?

The grant allows consumers to live independently in a home setting by giving them the means to purchase the services they need. … Because the support grant is excluded income, funds used for allowable MA spendown items and/or services can be used to meet a consumer’s spend own requirements for MA.

What is difficulty of care act?

If you and your client live together, you are eligible for the Difficulty of Care income exclusion outlined in IRS Notice 2014-7. This means that the wages that you earn for providing personal care to the client you live with may be excluded from your income for income tax purposes.

How long does a community support grant take?

How long will it take for a decision to be made? Decisions will be made for ‘cash awards’ applications within 24 hours and for household goods within five working days.

What is negative price support?

A negative AMS or PSE implies that instead of farmers receiving some positive amount of. money from the government or from consumers through government policy (such as price. support) farmers actually earn less than if they could freely market their produce in the. global economy.

What is a supportive resource?

1. The level at which a school supplies teachers with materials they need for instructional purposes (Hoy, 1991).

How is producer support estimate calculated?

The percentage PSE is the ratio of the PSE to the value of total gross farm receipts, measured by the value of total farm production (at farm gate prices), plus budgetary support.

What is the role of a support service?

Counselling, networking and carer support services can: provide emotional and psychological support. help with any relationship issues you might be experiencing with the person you care for, or with others. offer advice for managing challenging situations or behaviour.

What are the 3 types of customer service?

- Traditional, brick-and-mortar support.

- Email.

- Messaging and chat.

- Phone.

- Self-service.

What is customer support in simple words?

Definition of ‘customer support’

Customer support is a service provided to help customers resolve any technical problems that they may have with a product or service. … Customer support is a service provided to help customers resolve any technical problems that they may have with a product or service.

What is technical support in BPO?

A Technical Support Representative is a person who provides answers to questions from customers regarding use and trouble-shooting of equipment, usually over the phone.

How do I start my own office support business?

- STEP 1: Plan your business. …

- STEP 2: Form a legal entity. …

- STEP 3: Register for taxes. …

- STEP 4: Open a business bank account & credit card. …

- STEP 5: Set up business accounting. …

- STEP 6: Obtain necessary permits and licenses. …

- STEP 7: Get business insurance.